Debt Consolidation Vs Debt Management The Pros And Cons, And What To Know About Ascend Finance’s Cheating Accusations

The number of people choosing debt consolidation has increased in number tremendously nowadays. One of the main reasons for these is simplified monthly payments. People with multiple loans and debts might make their monthly payments due to various reasons like not remembering the due date due to multiple debts and loans, lack of funds, etc. As debt consolidation helps in combining all the debts and loans into one loan, making the monthly payment would be very easy. This means the chances for late payments would be very less.

Many people ignore checking the rate of interest when choosing debt consolidation. What you need to understand is, debt consolidation would not help you if you take the new loan at a much higher interest rate. There are lenders who can offer the loan at low-interest rates looking at your profile. You could approach such lenders to get the new loan at an attractive ROI. For finding trustworthy lenders, you must do thorough research online.

Most of the reputed lenders have their websites, where you can find all the important information related to their loan settlement options. You can check them to save your time. However, you cannot blindly trust the claims that are on the websites. Here is a quick suggestion that can help you make smart decisions.

There are some websites like the Fox Chronicle where you can find reviews and information related to various lenders. It is the kind of info that the lenders do not mention on their websites. Want to know about cheating accusations against Ascend Finance? Check out the review post on this website by Mac Venucci to know the truth.

Debt Management

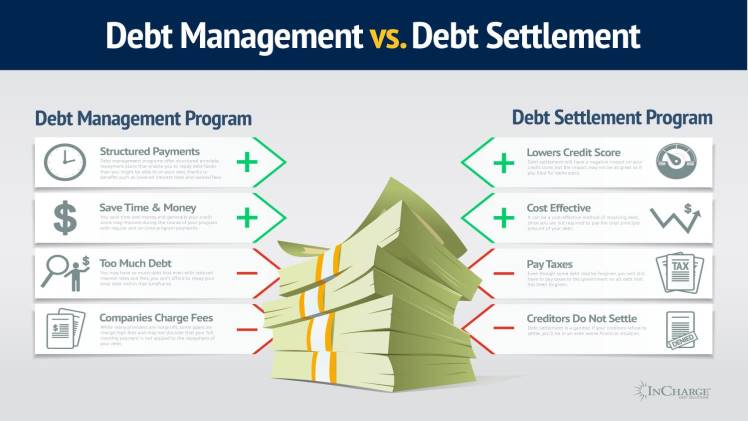

Debt management is exclusively designed to help candidates in managing their credit card debts. You might be having multiple credit cards and have so many due amounts, you can choose debt management for combining all your credit card debts into a single debt with one monthly payment. You will get this option with a comparatively low-interest rate. Debt management is not meant for personal loans, student loans, and other loans.

When to choose debt management?

If your credit score is too bad that you don’t qualify for debt consolidation, and have multiple credit card debts, choose debt management. The repayment term for debt management would be usually five years. However, this might differ from lender to lender. During your repayment period, you will not be allowed to take new credit cards. You cannot use your existing cards too. This means, no more balances will add up to your debt.

Whether you need advice about debt management or debt consolidation, you can always approach financial advisors online. By analysing your current financial condition, they will let you know about the options available for you to come out of your debts easily.

They will explain to you about the different products. Take their advice and do your research before making any decision. Never rush when making your decision. You can even take suggestions from your friends if they have used debt consolidation or debt management anytime in past.

Approach the right debt consolidation firm today for debt consolidation!