How To Excel at Forex Copy Trading

The foreign exchange market remains on top of all financial markets, with the largest daily trading volume and a huge number of participants engaging in buying and selling various currency pairs.

The Forex market involves many currencies that can be traded, with various ways to land a successful trading session and generate income.

Successful traders develop their own approaches to engage in the market, while others follow top Forex trading strategies, which proved their worth over the years. We will discuss one common strategy that most beginners start with Copy trading.

Understanding Copy Trading Strategy

Copy trading is one of the most famous ways to dip your toes in financial markets, where you simply follow professional traders’ approach to the market and mimic their plans.

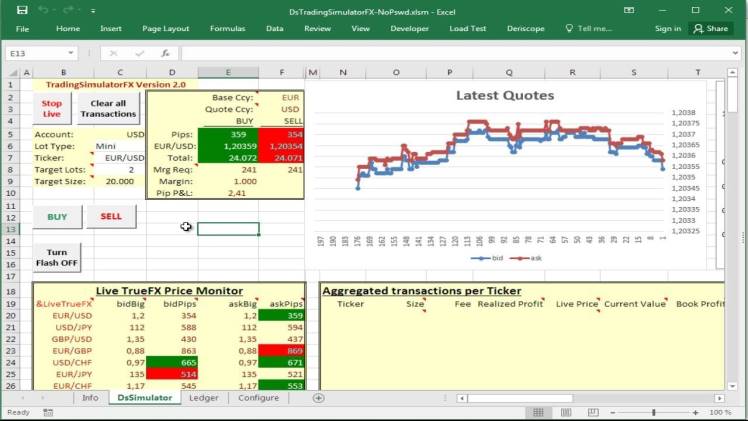

It is a common way to avoid rookie mistakes and directly get yourself on par with the most successful Forex investors. More importantly, most of today’s trading platforms offer automation features, which allow you to fully automate your copy trading strategy and gain in the market as long as the strategy owner is gaining.

Leading trading platforms let you choose the trader’s strategy you want to follow and the asset classes you want to invest in. All you have to do is select the strategy that suits you best and monitor the trading chart and order execution totally done by AI and machines.

Advantages of Copy Trading

If you decide to start your first steps with copy trading, here are the benefits that you may expect to gain.

- Shorten the learning curve and make it quickly into the market with fewer trial and error attempts.

- The ability to interfere and adjust your strategy if required.

- Save time on learning the market’s essentials, dynamics, analyses and trading platform’s tools.

- Higher chances to land a successful trade following the steps of successful traders.

- Full automation and order execution, relying on artificial intelligence to execute and learn from market inputs.

- Enabling traders to diversify portfolios with less effort through fully automated trading.

The Downside of Copy Trading

Copying the best Forex trading strategies sounds perfect. However, using this method has several disadvantages, such as the following.

- Full reliance on automated platforms and AI does not nurture learning and expanding market knowledge, and the trader will not be able to interfere with the right call should a system lag or face a delay.

- Following the best practices does not guarantee success in Forex because even the most successful traders’ plans might fail if the market goes sideways.

- Wealthy traders have higher risk tolerance than new traders and may take extensive risks that a basic trader cannot afford. Moreover, multimillionaire investors’ losses do not compare to a few thousand-dollar accounts.

Steps to Improve Your Copy Trading Strategy

Copy trading is a great first step for new traders who want to learn the essentials of markets and strategy planning. However, it is crucial to develop your strategy this way.

- Ensure you follow the strategies of several Forex traders and do not rely on only one strategy.

- Utilise the time you save on automation to increase your knowledge about the market and trading strategies.

- Adopt learning after every trading session or loss that you incur and keep adjusting your own strategy accordingly.

- Ensure you get the full picture of trading-automation fees. This can be tricky because it is easy to lose track when all your trades are automated.

Conclusion

Copy trading is tricky because it lowers the entry barriers for new traders and saves the time needed to learn the comprehensive market aspects. However, complete reliance can be hurtful, and you may not be able to read the market if unprecedented events occur, like natural disasters or bankruptcy.

Therefore, it is better to adopt the strategy and adapt it constantly to keep yourself in the race for the largest financial market and gain the fruits of artificial intelligence and automated trading.