Forex Market Liquidity – How Does It Work

Financial market dynamics are complicated because of the several factors that depend on each other, and one change can lead to a significant market change.

Liquidity is usually overlooked when discussing financial trading because most are concerned about the brokerage company or the trading platform. However, liquidity is the backbone of the trading system.

Let’s dive deeper into the Forex market liquidity and why it is an important concept.

Defining Liquidity in The Forex Market

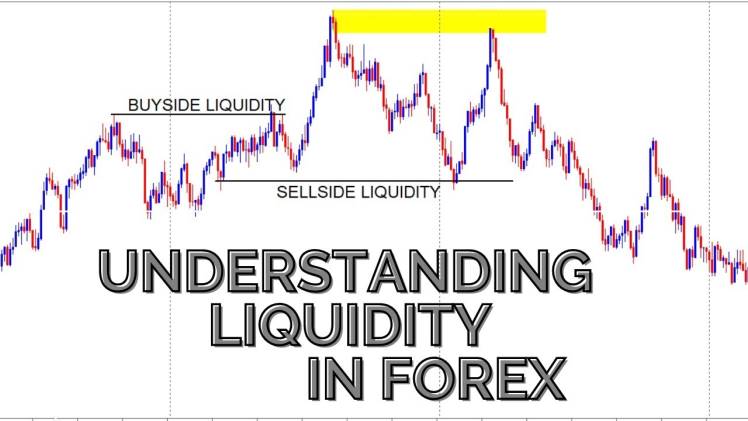

Liquidity defines how easily traders can buy and sell assets and execute market orders. Liquidity is usually associated with market dynamics and efficiency.

The high liquidity of Forex stems from the plethora of market participants trading from the wide choices of available assets, up to 180 currencies, creating various currency pairings to trade and succeed in the market.

A highly liquid asset means that many investors in the market are ready to buy and sell with you, and your order will be executed quickly and at the closest price possible to the real market value.

On the other hand, when markets are inefficient, slippage happens, and the spread becomes significant. Slippage happens when the order is executed at a different rate than the given market price, which occurs because of fractional delays in order matching.

Spread is another element of market liquidity, and highly liquid markets mean that many assets are available and supply levels are high. Therefore, the difference between the selling and buying price is small.

3 Symptoms of Liquid/Illiquid Markets

Market liquidity is an essential factor that must be considered before buying a specific asset(s). There are different ways to analyse market liquidity, including the following.

Peak Hours

Forex liquidity is at its highest in peak hours when two or more markets’ working hours overlap. For example, the UK and US markets are open between 13:00 and 17:00 UTC, marking the busiest trading session and most liquid.

Volume

Asset or market trading volume can be analysed in the chart options provided in the trader’s room, which provides insight into changes in liquidity and how many orders are executed/pending in the market.

Market Gaps

Forex market indifferences happen when significant announcements and news take place. In these times, market activity and liquidity change, and a trader can identify the liquidity of a certain currency pair.

Bottom Line

Liquidity is a crucial term to measure market efficiency. Traders look for markets with high liquidity to enjoy minimum slippage rates and tight spread ranges.

There are several ways to determine the liquidity level using gaps, volumes and peak hours when the market is at its top performance level.